IonQ Announces Third Quarter 2025 Financial Results

COLLEGE PARK, MD, November 05, 2025 -- IonQ, the world’s leading quantum company, today announced financial results for the quarter ended September 30, 2025.

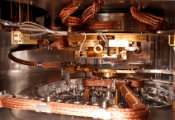

"I am pleased to report that we once again beat the high end of our revenue guidance, this time by 37%. We are also raising our revenue expectations for the full year to $110 million at the high end of guidance,” said Niccolo de Masi, Chairman and CEO of IonQ. “We delivered our 2025 technical milestone of #AQ 64 three months early, unlocking 36 quadrillion times more computational space than leading commercial superconducting systems. We achieved a truly historic milestone by demonstrating world-record 99.99% two-qubit gate performance, underscoring our path to 2 million qubits and 80,000 logical qubits in 2030.”

“Our technical achievements continue to solidify IonQ’s quantum platform as the most complete and powerful in the world, with a correspondingly larger addressable global market,” de Masi continued. “Our Electronic Qubit Control systems and world-record fidelity, combined with uniquely low unit economics at full fault tolerance, underpin IonQ as the global leader in a class of its own in quantum computing. Meanwhile, we are on a clear trajectory to deliver critical quantum cybersecurity infrastructure, ultra-precise quantum navigation, quantum timing solutions, and large-scale networked quantum systems.”

de Masi concluded, “Now with $3.5 billion of pro-forma net cash, we are continuing to reap the compounding benefits of our scale and momentum advantages, entrenching our position as the dominant force in quantum and the only complete platform solution. I am confident in our ability to deliver growth and value creation for IonQ shareholders in 2026.”

Financial Highlights

- IonQ recognized revenue of $39.9 million for the third quarter, which is 37% above the top end of the previously provided range and represents 222% year-over-year growth.

- Cash, cash equivalents, and investments were $1.5 billion as of September 30, 2025 and $3.5 billion pro-forma for the $2 billion equity offering that closed on October 14, 2025.

- Net loss was $1.1 billion, Adjusted EBITDA loss was $48.9 million, GAAP EPS was ($3.58) and Adjusted EPS was ($0.17) for the third quarter.

Q3 and Recent Commercial Highlights

- IonQ and a Swiss consortium launched the first citywide dedicated quantum network in Geneva as part of a landmark public-private initiative which includes CERN, Rolex SA, the Swiss government and academic institutions.

- IonQ collaborated with a top Global 1000 automotive manufacturer to demonstrate quantum chemistry simulations with greater accuracy than classical methods when simulating complex chemical systems that could potentially slow climate change.

- IonQ signed a memorandum of understanding with the U.S. Department of Energy to advance quantum technologies in space.

- IonQ demonstrated quantum power grid optimization advancements in partnership with Oak Ridge National Laboratory.

- IonQ announced a strategic collaboration with Emergence Quantum, expanding its presence in APAC and contributing to Australia’s growing quantum industry.

- KISTI named IonQ their primary quantum partner for the establishment of South Korea’s first National Quantum Computing Center of Excellence.

- IonQ awarded a new contract with Oak Ridge National Laboratory to advance quantum-classical workflows and develop real-world applications to tackle complex scientific and energy challenges.

Q3 and Recent Technical Highlights

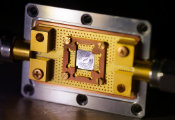

- IonQ achieved world-record 99.99% two-qubit gate performance, setting a new quantum computing world record and accelerating the company’s path to large-scale fault-tolerant systems.

- IonQ achieved record algorithmic qubit score of #AQ 64 on IonQ Tempo system three months ahead of schedule, establishing IonQ as the only company to reach #AQ 64 and exponentially expanding quantum computational power of IonQ systems.

- IonQ demonstrated quantum frequency conversion to telecom wavelengths, paving the way for interconnecting quantum computers using existing fiber optic infrastructure.

- IonQ demonstrated remote ion-ion entanglement, achieving a significant milestone in the development of networked quantum systems at scale.

- IonQ achieved a significant breakthrough in synthetic diamond materials for industrial applications, an essential hardware for clustered compute using standard semiconductor manufacturing techniques.

- IonQ surpassed 1,000 total intellectual property assets, fortifying its technological advantage and commercial quantum leadership.

Q3 and Recent Corporate Highlights

- IonQ completed its acquisition of Oxford Ionics, enabling scale, stability, and cost-savings by leveraging existing semiconductor manufacturing.

- IonQ completed its acquisition of Vector Atomic, strengthening IonQ’s full-stack quantum platform by adding the world’s most advanced quantum sensing capabilities.

- IonQ priced and completed a $2.0 billion equity offering, including shares and warrants, to facilitate global growth and accelerate IonQ’s quantum commercialization worldwide.

- IonQ created IonQ Federal to meet increasing demand for quantum advantage across the U.S. and allied governments, and appointed Dean Acosta Chief Corporate Affairs and Government Relations Officer, bringing more than three decades of experience in technology, defense and public service.

- IonQ appointed Inder M. Singh Chief Financial Officer and Chief Operating Officer, bringing significant financial acumen and more than three decades of experience guiding companies through periods of rapid and transformative growth.

- IonQ appointed Dr. Chris Ballance, President of Quantum Computing.

- IonQ appointed Dr. Marco Pistoia, CEO of IonQ Italia, as IonQ continues to deepen its investments in EMEA.

- IonQ hosted its 2025 Analyst Day, providing in-depth updates on business strategy, technology roadmap, and vision for its commercial quantum platform from a broad bench of leaders across corporate, government and academic domain expertise.

2025 Financial Outlook

- For the full year 2025, IonQ is raising its revenue expectations to between $106 million and $110 million.

- For the full year 2025, IonQ is reaffirming its Adjusted EBITDA loss midpoint guidance with a range of between ($206) million and ($216) million.

Upcoming Q4 2025 Conference Participation

IonQ to participate in the Bank of America 2025 Transforming World Conference taking place on Wednesday November 12, 2025. A webcast link to the keynote presentation will be available on our investor relations website.

IonQ to participate in the UBS Global Technology Conference taking place on Monday, December 1, 2025. A webcast link will be available on our investor relations website.

Third Quarter 2025 Conference Call

IonQ will host a conference call today at 4:30 p.m. Eastern time to review the Company’s financial results for the third quarter ended September 30, 2025 and to provide a business update. The call will be accessible by telephone at 844-826-3035 (domestic) or +1-412-317-5195 (international). The call will also be available live via webcast on the Company’s website here, or directly here. A telephone replay of the conference call will be available approximately three hours after its conclusion at 844-512-2921 (domestic) or +1-412-317-6671 (international) with access code 10203563 and will be available until 11:59 PM Eastern time, November 19, 2025. An archive of the webcast will also be available here shortly after the call and will remain available for one year.

Non-GAAP Financial Measures

To supplement IonQ’s condensed consolidated financial statements presented in accordance with GAAP, IonQ uses non-GAAP measures of certain components of financial performance. Adjusted EBITDA and Adjusted EPS are financial measures that are not required by or presented in accordance with GAAP. Management believes that these measures provide investors additional meaningful methods to evaluate certain aspects of the Company’s results period over period.

Adjusted EBITDA is defined as net loss attributable to IonQ, Inc. before net loss attributable to noncontrolling interests, interest income, interest expense, income tax (benefit) expense, depreciation and amortization, stock-based compensation, executive cash-based severance, change in fair value of warrant liabilities, offering costs associated with warrants and acquisition transaction and integration costs. Adjusted EPS is defined as earnings per share, or EPS, excluding the impact of stock-based compensation, executive cash-based severance, change in fair value of warrant liabilities, offering costs associated with warrants and acquisition transaction and integration costs. IonQ uses Adjusted EBITDA and Adjusted EPS to measure the operating performance of its business, excluding specifically identified items that it does not believe directly reflect its core operations and that may not be indicative of recurring operations.

The presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and IonQ’s non-GAAP measures may be different from non-GAAP measures used by other companies.