Infleqtion Appoints Ilan Hart as Chief Financial Officer

November 05, 2025 -- Infleqtion (or the “Company”), a global leader in neutral atom-based quantum technology, has appointed Ilan Hart as chief financial officer, effective October 20, 2025. Hart brings nearly 30 years of financial and commercial leadership across advanced technology sectors, including more than two decades at Intel, and most recently served as CFO for Zoox, Amazon’s Autonomous vehicle company. His appointment follows Infleqtion’s recently announced plan to go public through a business combination with Churchill Capital Corp X.

As CFO, Hart will oversee all corporate financial functions, including capital markets strategy, investor relations, and long-term financial planning. He will spearhead initiatives to identify and access capital markets, foster and manage key investor relationships, and advance the company’s strategic growth objectives.

“Ilan’s appointment comes at a pivotal moment for Infleqtion as we prepare to enter the public markets,” said Matt Kinsella, Chief Executive Officer of Infleqtion. “His experience guiding global technology companies through growth and transformation will be instrumental as we expand our commercial presence and strengthen our foundation for long-term success. I’m thrilled to welcome him to the team as we continue advancing our mission to deliver real-world impact across the full spectrum of quantum technologies.”

At Intel, Hart held many senior finance roles supporting the company’s largest global business, driving efficiency initiatives, disciplined capital allocation, and long-term growth across Intel’s worldwide platform. At Zoox, he helped guide the organization through rapid development, scaling toward commercial launch.

“I’m honored to join Infleqtion and be part of this unique company that is delivering real-world solutions in quantum computing and precision sensing,” said Ilan Hart. “Having spent my career at the intersection of advanced hardware and transformative technology, I look forward to applying that experience to capitalize on Infleqtion’s position of strength in the quantum market, executing with financial discipline, accelerating growth, and driving long-term shareholder value.”

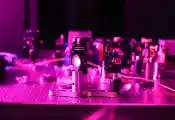

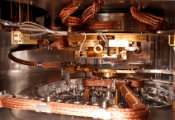

Infleqtion translates quantum technology into solutions that expand human potential. The company designs, builds, and sells quantum computers, precision sensors, and software to governments, enterprises, and research institutions. As a first-mover in neutral-atom technology, a leading quantum modality recognized for scalability, flexibility, and cost efficiency, Infleqtion has built a commercial platform that is practical, differentiated, and ready to scale. This architecture uniquely enables the company to power both quantum computing and precision sensing from a single technology foundation.

Infleqtion’s product portfolio includes quantum computers, quantum clocks, RF receivers, and inertial sensors, all engineered for real-world deployment and optimized with its proprietary software. These systems are already in use by the U.S. Department of War, NASA, and the U.K. government as well as multiple collaborations with NVIDIA. To date, Infleqtion has sold multiple quantum computers and hundreds of quantum sensors, generating approximately $29 million in trailing twelve-month revenue as of June 30, 2025, reflecting an ~80% CAGR over the past two years. The company expects approximately $50 million of booked and awarded business at year-end 2025, representing potential multi-year value expected to be realized over time, and has identified a potential customer pipeline exceeding $300 million, underscoring a promising growth trajectory.

The definitive business combination agreement between Infleqtion and Churchill Capital Corp X (NASDAQ: CCCX) values Infleqtion at a pre-money equity value of $1.8 billion and is expected to deliver over $540 million in gross transaction proceeds, including over $125 million of incremental financing via a common stock PIPE raised at the transaction value from leading existing and new institutional investors, and assuming no redemptions. Infleqtion expects to use proceeds from the transaction to accelerate its technology and product roadmap and expand applications into new end markets, unlocking additional use cases in artificial intelligence, national security, and space.