D-Wave Reports First Quarter 2025 Results

PALO ALTO, Calif., May 08 2025 -- D-Wave Quantum Inc., (“D-Wave” or the “Company”) a leader in commercial quantum computing systems, software, and services, today announced financial results for its first quarter ended March 31, 2025.

“The first quarter of 2025 was arguably the most significant in D-Wave’s history, especially in terms of our unique ability to deliver quantum value today to our customers and the scientific community,” said Dr. Alan Baratz, CEO of D-Wave. “We recognized revenue on our first Advantage system sale to a major research institution, moved an additional customer application into commercial production, and became the first to demonstrate quantum supremacy over classical computing on a useful real-world problem. The end result was a record revenue and gross profit quarter."

Recent Business and Technical Highlights

- Announced record revenue of $15.0 million for the first quarter of fiscal 2025. This is an increase of $12.5 million, or 509%, from revenue of $2.5 million for the first quarter of fiscal 2024.

- D-Wave’s consolidated cash balance totaled $304.3 million as of March 31, 2025, a record quarter-end balance for the Company. Management believes that its cash balance is sufficient to fund the Company to profitability.

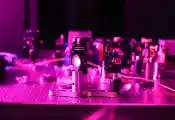

- Published the peer-reviewed paper “Beyond-Classical Computation in Quantum Simulation” in Science, validating D-Wave’s demonstration of quantum computational supremacy on a useful real-world problem. This research showed that D-Wave’s annealing quantum computer was able to perform a magnetic materials simulation in minutes that would take nearly one million years and more than the world’s electricity supply on one of today’s most powerful classical supercomputers, the Frontier massively parallel, GPU-based exascale supercomputer at the Oak Ridge National Laboratory. This marks the first time that any quantum computer has achieved quantum supremacy on a useful real-world problem.

- Announced that Ford Otosan has deployed a hybrid-quantum application in production, streamlining manufacturing processes for its Ford Transit line of vehicles. Using D-Wave technology, Ford Otosan reduced the scheduling time of 1,000 vehicles from 30 minutes to less than five minutes. Ford Otosan plans to activate quantum scheduling in additional body shops and extend to other processes, including paint shops, assembly lines and buffer zones.

- Announced the successful completion of a proof-of-concept with the pharmaceutical division of Japan Tobacco, which used D-Wave's Advantage quantum computer with artificial intelligence (AI) in the drug discovery process. This new approach resulted in molecular structures that are better candidates for subsequent drug development than structures created by purely classical methods. This could lead to improvements in both the quality and speed of drug development.

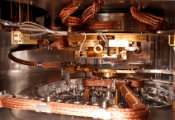

- Delivered and recognized revenue on the first Advantage system sale to a high-performance computing (HPC) center, the Jülich Supercomputing Centre. It is expected that D-Wave’s system will be connected to the JUPITER supercomputer, Europe’s first and only exascale HPC, to facilitate breakthroughs in AI and quantum optimization applications.

- Announced that the physical assembly of a D-Wave Advantage2 annealing quantum system is complete at Davidson Technologies’ headquarters in Huntsville, Alabama. Installation is now nearing completion as the system undergoes final calibration and readiness testing. The Advantage2 system at Davidson is designed to support mission-critical challenges in areas such as national defense and will eventually be housed in a secure facility developed to run sensitive applications.

- Introduced new hybrid quantum solver capabilities and additional use cases designed to drive usage of the Company’s quantum optimization offering. Enhancements to the nonlinear hybrid quantum solver include the ability to support continuous variables with linear interactions, thus enabling new use cases such as budget allocation and resource distribution. The Company’s expanded collection of optimization use cases also now includes offer allocation, portfolio optimization and maintenance repair operations optimization.

- Qubits 2025, D-Wave’s annual user conference, took place March 31 and April 1 with record attendance. In person attendance was up 23% year over year, and virtual attendance was up nearly 100% year over year. A number of D-Wave customers presented use cases based on D-Wave technology, including Davidson Technologies, Japan Tobacco, Jülich Supercomputing Centre, NTT DOCOMO, Pusan National University, Quantum Research Sciences, SAS, the University of Southern California and more.

- Published a new research paper titled “Blockchain with Proof of Quantum Work” that used quantum computation to generate and validate blockchain hashes. This research, which leveraged techniques from D-Wave’s quantum supremacy demonstration, indicates that using quantum computation for hashing and proof of work could potentially require a fraction of the electricity used by classical resources alone and reduce electricity costs by up to a factor of 1,000.

First Quarter Fiscal 2025 Financial Highlights

- Revenue: Revenue for the first quarter of fiscal 2025 was $15.0 million, an increase of $12.5 million, or 509%, from revenue of $2.5 million for the first quarter of fiscal 2024. The increase was primarily driven by the sale of a quantum computing system in the first quarter of fiscal 2025.

- Bookings: Bookings for the first quarter of fiscal 2025 were $1.6 million, a decrease of $2.9 million, or 64%, from the first quarter of fiscal 2024 Bookings of $4.5 million.

Customers: In comparing the most recent four quarters with the immediately preceding four quarters, D-Wave had a total of 133 customers compared with a total of 128 customers. The 133 customers includes 69 commercial customers (25 of which are Forbes Global 2000 customers), 52 research organizations, and 12government customers. - GAAP Gross Profit: GAAP gross profit for the first quarter of fiscal 2025 was a record $13.9 million, an increase of $12.2 million, or 736%, from the first quarter of fiscal 2024 GAAP gross profit of $1.7 million, with the increase due primarily to a higher margin system sale in the first quarter of fiscal 2025.

- GAAP Gross Margin: GAAP gross margin for the first quarter of fiscal 2025 was 92.5%, an increase of 25.2% from the first quarter of fiscal 2024 GAAP gross margin of 67.3%, with the increase due primarily to the higher margin system sale in the first quarter of fiscal 2025.

- Non-GAAP Gross Profit: Non-GAAP Gross Profit for the first quarter of fiscal 2025 was a record $14.0 million, an increase of $12.1 million, or 644%, from the first quarter of fiscal 2024 Non-GAAP Gross Profit of $1.9 million. The difference between GAAP and Non-GAAP Gross Profit is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP gross profit.

- Non-GAAP Gross Margin: Non-GAAP Gross Margin for the first quarter of fiscal 2025 was 93.6%, an increase of 17.0% from the first quarter of fiscal 2024 Non-GAAP Gross Margin of 76.6%. The difference between GAAP and Non-GAAP Gross Margin is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Margin.

- GAAP Operating Expenses: GAAP operating expenses for the first quarter of fiscal 2025 were $25.2 million, an increase of $6.0 million, or 31%, from the first quarter of fiscal 2024 GAAP operating expenses of $19.2 million, with the year-over-year increase primarily driven by increases of $3.1 million in salaries and related personnel costs as well as increases of $1.1 million in marketing expenses, $0.5 million in non-cash stock-based compensation, $0.4 million in third party professional services and $0.4 million in fabrication costs. The increased operating expenses stem from incremental investments to support the Company’s continued growth and expansion.

- Non-GAAP Adjusted Operating Expenses: Non-GAAP Adjusted Operating Expenses for the first quarter of fiscal 2025 were $20.2 million, an increase of $5.4 million, or 36%, from the first quarter of fiscal 2024 Non-GAAP Adjusted Operating Expenses of $14.8 million, with the difference between GAAP and Non-GAAP Adjusted Operating Expenses being primarily non-cash stock-based compensation expense, non-cash depreciation and amortization, and non-recurring one-time expenses.

- Net Loss: Net loss for the first quarter of fiscal 2025 was $5.4 million, or $0.02 per share, a decrease of $11.9 million, or $0.09 per share, from the first quarter of fiscal 2024 net loss of $17.3 million or $0.11 per share. The lower net loss was primarily driven by a $12.2 million increase in gross profit associated with the sale of a quantum computing system.

- Adjusted EBITDA Loss: The Adjusted EBITDA Loss for the first quarter of fiscal 2025 was $6.1 million, a decrease of $6.8 million, or 53%, from the first quarter of fiscal 2024 Adjusted EBITDA Loss of $12.9 million, with the decrease due primarily to the increase in revenue, partially offset by higher operating expenses, driven by the Company’s increased investment in its go-to-market and research and development organizations.