Quantum Computing Inc. Reports First Quarter 2025 Financial Results

HOBOKEN, NJ, May 15 2025 -- Quantum Computing Inc. (“QCi” or the “Company”), an innovative, integrated photonics and quantum optics technology company, today released financial results for the three-month period ended March 31, 2025.

Dr. Yuping Huang, Interim Chief Executive Officer of QCi, commented, “QCi delivered solid operational and financial progress in the first quarter, strengthening our balance sheet and advancing key strategic initiatives. We completed construction during the quarter of our Quantum Photonic Chip Foundry in Tempe, Arizona, a major milestone that positions us to meet growing demand for thin film lithium niobate (TFLN) photonic chips, underscored by the announcement of a fifth purchase during the period. We’re encouraged by our early traction, which is the first step in what we believe is a significant, multi-year opportunity to serve the expanding markets in datacom, telecom, and quantum-enabled applications. In parallel, we continued to deepen engagement with both government and commercial partners, reinforcing the growing interest in our quantum and photonic machines and positioning QCi to capitalize on emerging opportunities ahead.”

First Quarter 2025 Financial Highlights

- First quarter 2025 revenues totaled approximately $39,000 (33% gross margin) compared to $27,000 (41% gross margin) generated in the first quarter of 2024. Gross margin can vary at our current revenue levels. As such, the year-over-year decrease is not unexpected.

- First quarter 2025 operating expenses totaled $8.3 million compared to the previous year’s first quarter operating expenses of $6.3 million. The year-over-year increase was primarily driven by higher employee-based expenses.

- The Company reported net income attributable to common stockholders of $17.0 million, or $0.13 per basic share for the first quarter of 2025, compared to a net loss attributable to common stockholders of $6.4 million or $(0.08) per basic share for the same period of the previous year. The increase in net income this quarter was primarily due to a $23.6 million non-cash gain on the mark-to-market valuation of the Company’s warrant liability as a result of our merger with QPhoton in June 2022.

- Total assets at March 31, 2025 were $242.5 million, increasing from $153.6 million at December 31, 2024. Cash and cash equivalents at March 31, 2025 increased by $87.5 million to $166.4 million from year-end 2024. During the first quarter, the Company raised total net proceeds of $93.6 million through a private placement offering of common stock.

- Total liabilities at March 31, 2025 were $21.7 million, a decrease of $24.6 million compared to year-end 2024, driven primarily by the previously-mentioned non-cash changes in the fair value of the Company’s warrant liability.

- As of March 31, 2025, the Company had shareholders’ equity totaling $220.8 million.

First Quarter 2025 Operational Highlights

- Quantum Photonic Chip Foundry Update:

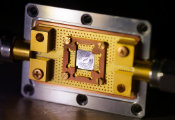

During the quarter, QCi completed construction of its Quantum Photonic Chip Foundry in Tempe, Arizona, achieving a key milestone in scaling its U.S.-based TFLN manufacturing services. The Company is now establishing its process design kit (PDK) and filling customer orders. To date, the Company has received five initial orders for its foundry services.

- Advancing Quantum Machine Adoption:

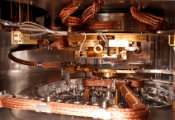

On January 15, 2025, QCi announced a collaboration with Sanders Tri-Institutional Therapeutics Discovery Institute (Sanders TDI), a non-profit drug discovery institute comprising Memorial Sloan Kettering Cancer Center, The Rockefeller University, and Weill Cornell Medicine. Through this partnership, Sanders TDI will leverage cloud-based access to QCi’s Dirac-3 quantum optimization machine to support computational chemistry and biomolecular modeling research. This collaboration highlights growing adoption of QCi’s quantum systems in real-world biomedical applications.

- Board Appointment Strengthens Strategic Leadership:

On March 26, 2025, QCi appointed Eric Schwartz to its Board of Directors. Mr. Schwartz brings over 20 years of experience in corporate finance, mergers and acquisitions, and corporate strategy, with a strong track record guiding companies through commercialization and manufacturing scale-up. His expertise will support QCi’s growth initiatives as the Company advances its TFLN chip foundry and drives market adoption of its quantum machines.

- Strengthening Sales & Market Presence:

The Company continued to expand its commercial and government engagement, participating in numerous trade shows and conferences during the quarter to showcase its quantum optimization and photonic chip solutions to prospective customers and partners.

- Advancing Strategic Partnerships with NASA:

Subsequent to the quarter on April 30, 2025, QCi was awarded a subcontract valued at approximately $406,000 through Analytical Mechanics Associates (AMA) to support NASA’s Langley Research Center. Under the project, QCi will use its Dirac-3 quantum computer to develop a quantum-based technique for removing sunlight noise from space-based LIDAR data, an obstacle that has historically limited NASA’s ability to conduct reliable daytime Earth observation. This project builds on QCi’s prior work with NASA.

Expanding Commercial Adoption of Quantum Solutions: Subsequent to the quarter, QCi secured two additional customer orders, reflecting growing global demand for its quantum machines. On April 1, 2025, the Company announced the sale of a Quantum Photonic Vibrometer to the Department of Aerospace Structures and Materials at Delft University of Technology in the Netherlands, supporting advanced research in non-destructive testing and structural health monitoring. Later in the month, on April 22, 2025, QCi announced the sale of an EmuCore reservoir computing device to a major automotive manufacturer for research and development use. These orders underscore QCi’s strategy to broaden awareness and adoption of its quantum solutions across both academic and industrial markets globally.