D-Wave Reports Third Quarter 2025 Results

PALO ALTO, Calif., November 06, 2025 -- D-Wave Quantum Inc. (“D-Wave” or the “Company”), a leader in commercial quantum computing systems, software, and services, today announced financial results for its third fiscal quarter ended September 30, 2025.

“Our strong third quarter results reflect the momentum we see building across every aspect of our business, with key metrics, including revenue, gross profit, bookings and cash balance, clearly indicating D-Wave’s success in accelerating global quantum computing adoption,” said Dr. Alan Baratz, CEO of D-Wave. “The world is watching quantum, and specifically D-Wave, as we deliver quantum computing’s value to businesses, researchers and governments now, while advancing the technology for even greater impact and scale in the future.”

Recent Business and Technical Highlights

- Announced revenue of $3.7 million for the third quarter of fiscal 2025. This is an increase of $1.8 million, or 100%, from revenue of $1.9 million for the third quarter of fiscal 2024.

- Closed Bookings of $2.4 million for the third quarter of fiscal 2025, up 80% from the immediately preceding second quarter Bookings of $1.3 million.

- Announced a fourth quarter 2025 booking of €10 million for 50% capacity of a D-Wave Advantage2annealing quantum computer that supports the development of a state-of-the-art quantum computing and research facility in Lombardy, Italy. In partnership with the Italian government and the Q-Alliance, the agreement includes acquisition of 50% capacity of an Advantage2 system for five years with the option to purchase the full system. In addition, D-Wave started a series of workshops in Italy to advance annealing quantum computing awareness and adoption among leading universities in the region.

- Signed a number of new and renewing customer engagements for both commercial and research applications, including: one of the largest U.S.-based international airlines; SkyWater – the nation's largest pure-play semiconductor foundry; the pharmaceutical division of Japan Tobacco; Yapi Kredi – one of the leading banks in Turkey; Korea Quantum Computing – a company specializing in quantum computing R&D, quantum security solutions and AI infrastructure in Korea; and a number of major universities around the globe.

- Collaborated with customers on a variety of quantum hybrid applications, including BASF, one of the world’s leading chemical companies, to optimize manufacturing workflows in a BASF liquid filling facility. D-Wave also successfully completed a joint proof-of-technology with North Wales Police, demonstrating positive results for optimizing forward deployment of police vehicles for incident response.

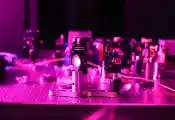

- Named as a winner in Fast Company’s 2025 Next Big Things in Tech Awards, which recognizes emerging technologies that have the potential to profoundly impact industries. D-Wave was acknowledged for “showing what quantum computing can do right now” and its powerful and energy-efficient 4,400+ qubit Advantage2quantum computer was highlighted.

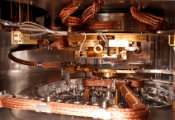

- Completed the fabrication of fluxonium qubit chips and superconducting control chips, and are currently bonding the two to demonstrate scalable control of gate model qubits. D-Wave expects this work will enable the first ever scalable gate model system with cryogenic control.

- Announced that calibration of the Advantage2 system installed at Davidson Technologies in Huntsville, Alabama is now complete, and that the system is now operational and accessible for customer use. The system is expected to enable development of quantum applications tailored to address U.S. government mission critical challenges, particularly in national defense.

- Hosted the first ever Qubits Japan 2025 quantum computing conference in Tokyo, a highly-attended event including representatives from many of the leading companies in Japan. In addition to D-Wave's CEO Dr. Alan Baratz and Chief Development Officer Dr. Trevor Lanting, speakers included Hidetoshi Nishimori, professor emeritus at the Institute of Science Tokyo, widely considered the father of annealing quantum technology, as well as representatives from Japan Tobacco Inc., NTT DOCOMO Inc. and Tohoku University.

- Expanded global awareness of the Company’s commercial-grade quantum computing technology and impactful customer success stories at a series of high-profile U.S. and international industry events including: Quantum World Congress; SEMICON Taiwan; FintechNation 25; Finnish Quantum Days 2025; Quantum Beach; Digital Innovation Forum: ComoLake2025; and LA Tech Week.

- Expanded the executive leadership team with the hiring of industry veteran Stan Black as the Company’s chief information security officer (CISO).

- Announced that Qubits 2026, D-Wave's highly-anticipated annual quantum computing user conference, will take place on January 27-28, 2026 in Boca Raton, FL.

Third Quarter Fiscal 2025 Financial Highlights

- Revenue: Revenue for the third quarter of fiscal 2025 was $3.7 million, an increase of $1.8 million, or 100%, from the fiscal 2024 third quarter revenue of $1.9 million, and an increase of $0.6 million, or 8%, from the immediately preceding fiscal 2025 second quarter revenue of $3.1 million.

- Bookings: Bookings for the third quarter of fiscal 2025 were $2.4 million, an increase of $0.1 million, or 3%,from the fiscal 2024 third quarter Bookings of $2.3 million, and an increase of $1.1 million, or 80%, from the immediately preceding fiscal 2025 second quarter Bookings of $1.3 million. Subsequent to the end of the third quarter, the Company has closed over $12 million in additional Bookings.

- Customers: For the most recent four quarters, D-Wave had in excess of 100 revenue generating customers including nearly two dozen Forbes Global 2000 companies.

- GAAP Gross Profit: GAAP gross profit for the third quarter of fiscal 2025 was $2.7 million, an increase of $1.7 million, or 156%, from the fiscal 2024 third quarter GAAP gross profit of $1.0 million, and an increase of $0.7 million, or 35%, from the immediately preceding fiscal 2025 second quarter GAAP gross profit of $2.0 million, with the increase due primarily to the growth in revenue.

- GAAP Gross Margin: GAAP gross margin for the third quarter of fiscal 2025 was 71.4%, an increase of 15.6% from the fiscal 2024 third quarter GAAP gross margin of 55.8%, and an increase of 6% from the immediately preceding fiscal 2025 second quarter GAAP gross margin of 63.8% with the increase primarily due to the upgrade of the previously announced Jülich Supercomputing Centre Advantage system to an Advantage2processor during the three months ended September 30, 2025.

- Non-GAAP Gross Profit: Non-GAAP Gross Profit for the third quarter of fiscal 2025 was $2.9 million, an increase of $1.6 million, or 131%, from the fiscal 2024 third quarter Non-GAAP Gross Profit of $1.3 million. The difference between GAAP and Non-GAAP Gross Profit is limited to non-cash stock-based compensation, and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Profit.

- Non-GAAP Gross Margin: Non-GAAP Gross Margin for the third quarter of fiscal 2025 was 77.7%, an increase of 10.5% from the fiscal 2024 third quarter Non-GAAP Gross Margin of 67.2%. The difference between GAAP and Non-GAAP Gross Margin is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Margin.

- GAAP Operating Expenses: GAAP Operating Expenses for the third quarter of fiscal 2025 were $30.4 million, an increase of $8.7 million, or 40%, from the fiscal 2024 third quarter GAAP Operating Expenses of $21.7 million with the increase driven primarily by increases of $4.1 million in personnel costs, $2.9 million in fabrication costs and $2.3 million in non-cash stock-based compensation. The increased operating expenses stem from incremental investments to support the Company’s continued growth and expansion.

- Non-GAAP Adjusted Operating Expenses: Non-GAAP Adjusted Operating Expenses for the third quarter of fiscal 2025 were $23.5 million, an increase of $8.4 million, or 56% from the fiscal 2024 third quarter Non-GAAP Adjusted Operating Expenses of $15.1 million, with the difference between GAAP and Non-GAAP Adjusted Operating Expenses being primarily non-cash stock-based compensation expense, depreciation and amortization, and non-recurring one-time expenses.

- Net Loss: Net loss for the third quarter of fiscal 2025 was $140.0 million, or $0.41 per share, an increase of $117.3 million, or $0.30 per share, from the fiscal 2024 third quarter net loss of $22.7 million, or $0.11 per share. The increase was primarily due to $121.9 million in non-cash, non-operating charges related to the remeasurement of the Company's warrant liability, as well as realized losses stemming from warrant exercises, that materially increased as a result of the significant price appreciation of the Company's warrants.

- Adjusted Net Loss: Adjusted Net Loss for the third quarter of fiscal 2025 was $18.1 million, or $0.05 per share, a decrease of $5.1 million, and a decrease of $0.07 per share, from the fiscal 2024 third quarter Adjusted Net Loss of $23.2 million, or $0.12 per share, with the difference between Net Loss and Adjusted Net Loss being non-cash, non-operating warrant remeasurement related charges.

- Adjusted EBITDA Loss: Adjusted EBITDA Loss for the third quarter of fiscal 2025 was $20.6 million, an increase of $6.8 million, or 49%, from the fiscal 2024 third quarter Adjusted EBITDA Loss of $13.8 million with the increase due primarily to higher operating expenses, partly offset by higher gross profit.

Financial Results for the First Nine Months of Fiscal Year 2025

- Revenue: Revenue for the nine months ended September 30, 2025 was $21.8 million, an increase of $15.3 million, or 235%, from revenue of $6.5 million for the nine months ended September 30, 2024.

- Bookings: Bookings for the nine months ended September 30, 2025 were $5.3 million, a decrease of $0.3 million, or 7%, from Bookings of $5.6 million for the nine months ended September 30, 2024.

- GAAP Gross Profit: GAAP gross profit for the nine months ended September 30, 2025 was $18.5 million, an increase of $14.4 million, or 353%, from $4.1 million in GAAP gross profit for the nine months ended September 30, 2024, with the increase due primarily to a higher margin quantum computer system sale during the nine months ended September 30, 2025.

- GAAP Gross Margin: GAAP gross margin for the nine months ended September 30, 2025 was 84.8%, an increase of 22.1% from the 62.7% GAAP gross margin for the nine months ended September 30, 2024, with the increase due primarily to a higher margin quantum computer system sale during the nine months ended September 30, 2025.

- Non-GAAP Gross Profit: Non-GAAP Gross Profit for the nine months ended September 30, 2025 was $19.2 million, an increase of $14.5 million, or 304%, from the Non-GAAP Gross Profit of $4.7 million for the nine months ended September 30, 2024. The difference between GAAP and Non-GAAP Gross Profit is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Profit.

- Non-GAAP Gross Margin: Non-GAAP Gross Margin for the nine months ended September 30, 2025 was 87.8%, an increase of 15.1% from the 72.7% Non-GAAP Gross Margin for the nine months ended September 30, 2024. The difference between GAAP and Non-GAAP Gross Margin is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Margin.

- GAAP Operating Expenses: GAAP Operating Expenses for the nine months ended September 30, 2025 were $84.1 million, an increase of $23.0 million, or 38%, from GAAP Operating Expenses of $61.1 million for the nine months ended September 30, 2024, with the year-over-year increase primarily driven by increases of $10.7 million in salaries and related personnel costs, 78% of which relates to increases in Sales & Marketing and Research & Development personnel; $5.3 million in non-cash stock-based compensation, $4.9 million in fabrication costs, $1.9 million in marketing expenses and $1.1 million in third party professional services. The increased operating expenses stem from incremental investments to support the Company’s continued growth and expansion.

- Non-GAAP Adjusted Operating Expenses: Non-GAAP Adjusted Operating Expenses for the nine months ended September 30, 2025 were $65.9 million, an increase of $20.5 million, or 45%, from Non-GAAP Adjusted Operating Expenses of $45.4 million for the nine months ended September 30, 2024, with the difference between GAAP and Non-GAAP Operating Expenses being primarily non-cash stock-based compensation expense, depreciation and amortization expense, and non-recurring one-time expenses.

- Net Loss: Net loss for the nine months ended September 30, 2025 was $312.7 million, or $1.01 per share, an increase of $254.9 million, or $0.69 per share, compared with a net loss of $57.8 million, or $0.32 per share for the nine months ended September 30, 2024. The increase was primarily due to $260.0 million in non-cash, non-operating charges related to the remeasurement of the Company's warrant liability, as well as realized losses stemming from warrant exercises.

- Adjusted Net Loss: Adjusted Net Loss for the nine months ended September 30, 2025 was $52.8 million, or $0.17 per share, a decrease of $5.1 million, or $0.15 per share, when compared with the Adjusted Net Loss of $57.8 million, or $0.32 per share for the nine months ended September 30, 2024, with the difference between Net Loss and Adjusted Net Loss being non-cash, non-operating warrant remeasurement related charges.

- Adjusted EBITDA Loss: Adjusted EBITDA Loss for the nine months ended September 30, 2025 was $46.7 million, an increase of $6.1 million, or 15%, from the Adjusted EBITDA Loss of $40.6 million for the nine months ended September 30, 2024, with the increase due primarily to higher operating expenses, partly offset by higher gross profit.