BTQ Technologies Unveils Quantum Stablecoin Settlement Network (QSSN)

VANCOUVER, BC, June 24 2025 -- BTQ Technologies Corp. (the "Company"), a global quantum technology company focused on securing mission-critical networks, is pleased to introduce the Quantum Stablecoin Settlement Network (QSSN), a next-generation framework designed to protect stablecoin platforms from emerging cybersecurity risks driven by quantum computing.

QSSN will provide banks, payment companies, and digital asset platforms with the tools to issue and manage stablecoins in alignment with evolving regulatory and national security standards. The framework is designed to support a broad range of stablecoin models, including:

- JPMorgan Chase's proposed USD deposit token (JPMD)

- Leading fiat-backed stablecoins like Circle and Tether USD

- Regulated, bank-issued stablecoins such as the forthcoming Fire Labs Stablecoin, which has commenced to power wallets in Kraken and Blockchain.com

- Real-world asset tokens and other next-generation digital payment products

Supporting the Next Phase of Stablecoin Market Growth

The stablecoin sector has rapidly expanded into a $225 billion market, with growing institutional demand, real-world applications, and regulatory clarity accelerating adoption. As stablecoins become more embedded in global financial infrastructure, governments and regulators are introducing new requirements to ensure their long-term security, particularly in response to the growing capabilities of quantum computing, which threaten to undermine legacy encryption systems.

In the U.S., recent federal mandates call for quantum-safe technology across critical infrastructure, including digital assets and tokenized financial products. BTQ's QSSN is designed to help stablecoin issuers meet these requirements by adding a secure, future-proof layer to the most sensitive aspects of stablecoin platforms, without changing how businesses, institutions, or users interact with these digital currencies.

Demonstrating a Quantum-Secure JPMorgan Stablecoin

BTQ's QSSN provides a clear pathway to future-proof the proposed JPMorgan Chase USD deposit token (JPMD) in line with U.S. federal cybersecurity standards. Recent policies, including National Security Memorandum-10 and the NSA's Commercial National Security Algorithm Suite 2.0, require critical financial systems to migrate to quantum-resistant cryptography before 2030, with many standards already in effect.

BTQ's solution would allow JPMorgan—or any issuer of tokenized deposits—to secure their stablecoin platform by upgrading only the core functions used by the bank's treasury or designated operator, such as:

- Minting and burning tokens

- Administrative controls, such as pauses or upgrades

- Initial contract deployment

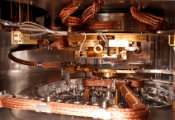

Using BTQ's proprietary CASH hardware and QSSN framework, these privileged transactions will be cryptographically signed with both standard ECDSA keys and quantum-safe Falcon-512 signatures. This allows for compliance with emerging quantum security mandates while preserving all existing token logic, KYC processes, allow-list requirements, and user workflows.

The broader stablecoin ecosystem remains unchanged, meaning:

- Institutional and retail holders interact with the token as they do today

- Existing wallets, reconciliation processes, and regulatory reporting remain intact

- Only the issuer's authentication path adopts quantum-safe protections

This approach offers improved security with reduced disruption, which will allow major financial institutions to comply with U.S. quantum-resilience policies without overhauling their operational infrastructure.

A Market-Ready, Scalable Solution

The QSSN framework will enhance security for core stablecoin functions while maintaining full compatibility with existing payment systems and compliance processes. It will enable seamless adoption for both new and existing stablecoin issuers, positioning BTQ as a critical technology provider for secure, scalable digital finance.

"The growth of stablecoins is reshaping global payments and financial markets, but these platforms must be built on secure foundations," said Olivier Roussy Newton, CEO and Chairman of BTQ Technologies. "QSSN positions BTQ at the forefront of this transformation, will enable banks, institutions, and innovators to meet emerging regulatory expectations for quantum security, without disrupting user experience or market functionality."

Roussy Newton added: "Quantum technologies will be first and foremost widely deployed in digital currencies—and BTQ is positioned to lead the market."

Capitalizing on Market Growth and Regulatory Tailwinds

Stablecoins have become a critical part of the digital asset economy, powering real-world asset tokenization, payments, cross-border settlement, and yield-generating financial products. At the same time, governments are accelerating timelines for quantum-proofing national infrastructure, presenting both a challenge and a significant market opportunity for technology providers.

In the United States, the pending GENIUS Act—a bipartisan bill advancing through Congress—seeks to establish comprehensive federal guidelines for fiat-backed stablecoins, further reinforcing the need for secure, compliant, and resilient digital currency infrastructure. With the introduction of the GENIUS Act and its anticipated approval, there will come a time—sooner rather than later—when digitized money becomes mandated by law.

BTQ, having collaborated with NIST and other standards bodies for over a decade, is committed to shaping that future. The Company intends to actively propose technical legislation and standards to ensure that digital currencies, including stablecoins, are built on quantum-secure foundations.

With QSSN, BTQ will offer a scalable, revenue-generating platform to support secure stablecoin issuance and management, enabling banks, payment providers, and digital asset companies to confidently meet both market demand and regulatory expectations in the years ahead.