D-Wave Reports Second Quarter 2025 Results

PALO ALTO, Calif., August 07, 2025 -- D-Wave Quantum Inc. (“D-Wave” or the “Company”), a leader in commercial quantum computing systems, software, and services, today announced financial results for its secondquarter ended June 30, 2025.

“Our second quarter results show consistently strong performance across a multitude of technical and business metrics,” said Dr. Alan Baratz, CEO of D-Wave. “During the quarter, we brought to market our sixth-generation quantum computer, signed a memorandum of understanding related to the acquisition of an on-premises system in South Korea, completed physical assembly of the previously announced system at Davidson Technologies, introduced a collection of developer tools to advance quantum AI and machine learning innovation, and ended the quarter with a record $819 million in cash. We’re confident in our ability to continue delivering long-term value for our customers, partners and shareholders.”

Recent Business and Technical Highlights

- Announced revenue of $3.1 million for the second quarter of fiscal 2025. This is an increase of $0.9 million, or 42%, from revenue of $2.2 million for the second quarter of fiscal 2024.

- Completed a successful $400 million At-the-Market (ATM) equity offering, contributing to D-Wave’s consolidated cash balance of approximately $819 million as of June 30, 2025, a record quarter-end balance for the Company. The Company intends to use the proceeds from this financing primarily for strategic acquisitions and general corporate purposes including providing additional working capital and funding capital expenditures.

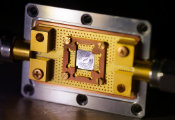

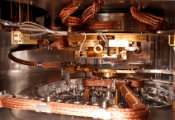

- Announced the general availability of D-Wave’s Advantage2 quantum computer, its most advanced and performant system. The Advantage2 system is a powerful and energy-efficient annealing quantum computer capable of solving computationally complex problems beyond the reach of classical computers. Featuring D-Wave’s most advanced quantum processor to date, the Advantage2 system is commercial-grade, and built to address real-world use cases in areas such as optimization, materials simulation and artificial intelligence. The system features increased connectivity, reduced noise, greater coherence, and increased energy scale, all contributing to faster and higher quality solutions.

- Announced a new strategic development initiative focused on advanced cryogenic packaging. Designed to advance and scale both gate model and annealing quantum processor development, the initiative builds on D-Wave’s technology leadership in superconducting cryogenic packaging and will expand its multichip packaging capabilities, equipment, and processes. By bolstering D-Wave’s manufacturing efforts with state-of-the-art technology, the Company aims to accelerate its development efforts in support of its aggressive product roadmap on the path to 100,000 qubits.

- Released a collection of offerings to help developers explore and advance quantum artificial intelligence (AI) and machine learning (ML) innovation, including an open-source quantum AI toolkit and a demo. The quantum AI toolkit enables developers to seamlessly integrate quantum computers into modern ML architectures. The demo illustrates how developers can leverage this toolkit to explore using D-Wave quantum processors to generate simple images, reflecting a pivotal step in the development of quantum AI

- Announced a strategic relationship with Yonsei University and Incheon Metropolitan City to accelerate the exploration, adoption and usage of quantum computing in South Korea. Under the terms of the memorandum of understanding (MOU), the three organizations intend to work together to advance mutual research and talent development for quantum computing, provide access to D-Wave’s quantum computing systems and services, and collaborate on development of use cases in biotechnology, materials science and other areas. In addition, the MOU facilitates the organizations’ efforts towards the acquisition of a D-Wave Advantage2 system at the Yonsei University International Campus in Songdo, Yeonsu-gu, Incheon.

- Signed a number of new and renewing customer engagements for both commercial and research applications, including E.ON – a European multinational electric utility company; GE Vernova – a global energy company; National Quantum Computing Centre (NQCC) – the UK’s national lab for quantum computing; Nikon Corporation – a multinational corporation specializing in optics and precision technologies; NTT Data Corp. – a multinational IT services and consulting company; NTT DOCOMO – Japan’s leading mobile operator; Sharp Corporation – a multinational electronics company; and the University of Oxford.

Second Quarter Fiscal 2025 Financial Highlights

- Revenue: Revenue for the second quarter of fiscal 2025 was $3.1 million, an increase of $0.9 million, or 42%, from the fiscal 2024 second quarter revenue of $2.2 million.

- Bookings: Bookings for the second quarter of fiscal 2025 were $1.3 million, an increase of $0.6 million, or 92%, from the fiscal 2024 second quarter Bookings of $0.7 million.

- Customers: For the most recent four quarters, D-Wave had in excess of 100 revenue generating customers.

- GAAP Gross Profit: GAAP gross profit for the second quarter of fiscal 2025 was $2.0 million, an increase of $0.6 million, or 42%, from the fiscal 2024 second quarter GAAP gross profit of $1.4 million, with the increase due primarily to the growth in revenue.

- GAAP Gross Margin: GAAP gross margin for the second quarter of fiscal 2025 was 63.8%, an increase of 0.2% from the fiscal 2024 second quarter GAAP gross margin of 63.6%.

- Non-GAAP Gross Profit: Non-GAAP Gross Profit for the second quarter of fiscal 2025 was $2.2 million, an increase of $0.6 million, or 39%, from the fiscal 2024 second quarter Non-GAAP Gross Profit of $1.6 million. The difference between GAAP and Non-GAAP Gross Profit is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Profit.

- Non-GAAP Gross Margin: Non-GAAP Gross Margin for the second quarter of fiscal 2025 was 71.8%, a decrease of 1.3% from the fiscal 2024 second quarter Non-GAAP Gross Margin of 73.1%. The difference between GAAP and Non-GAAP Gross Margin is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Margin.

- GAAP Operating Expenses: GAAP operating expenses for the second quarter of fiscal 2025 were $28.5 million, an increase of $8.3 million, or 41%, from the fiscal 2024 second quarter GAAP Operating Expenses of $20.2 million with the increase driven primarily by increases of $3.5 million in personnel costs, $2.4 million in non-cash stock-based compensation, $1.6 million in fabrication and related activities and $1.5 million in third party professional fees, partly offset by a recovery on a previously written-off debt of $1.1 million. The increased operating expenses stem from incremental investments to support the Company’s continued growth and expansion.

- Non-GAAP Adjusted Operating Expenses: Non-GAAP Adjusted Operating Expenses for the second quarter of fiscal 2025 were $22.2 million, an increase of $6.7 million, or 43% from the fiscal 2024 second quarter Non-GAAP Adjusted Operating Expenses of $15.5 million, with the difference between GAAP and Non-GAAP Adjusted Operating Expenses being primarily non-cash stock-based compensation expense, non-cash depreciation and amortization, and non-recurring one-time expenses.

- Net Loss: Net loss for the second quarter of fiscal 2025 was $167.3 million, or $0.55 per share, an increase of $149.5 million, or $0.45 per share, from the fiscal 2024 second quarter net loss of $17.8 million, or $0.10 per share. The increase was primarily due to $142.0 million in non-cash, non-operating charges related to the remeasurement of the Company's warrant liability, as well as realized losses stemming from warrant exercises, that materially increased as a result of the significant price appreciation of the Company's warrants.

- Adjusted Net Loss: Adjusted Net Loss for the second quarter of fiscal 2025 was $25.3 million, or $0.08 per share, an increase of $5.3 million, and a decrease of $0.04 per share, from the fiscal 2024 second quarter Adjusted Net Loss of $20.0 million, or $0.12 per share, with the difference between Net Loss and Adjusted Net Loss being non-cash, non-operating warrant remeasurement related charges.

- Adjusted EBITDA Loss: Adjusted EBITDA Loss for the second quarter of fiscal 2025 was $20.0 million, an increase of $6.1 million, or 44%, from the fiscal 2024 second quarter Adjusted EBITDA Loss of $13.9 million with the increase due primarily to higher operating expenses, partly offset by higher gross profit.

Financial Results for the First Half of Fiscal Year 2025

- Revenue: Revenue for the six months ended June 30, 2025 was $18.1 million, an increase of $13.5 million, or 289%, from revenue of $4.6 million for the six months ended June 30, 2024.

- Bookings: Bookings for the six months ended June 30, 2025 were $2.9 million, a decrease of $0.4 million, or 13%, from Bookings of $3.3 million for the six months ended June 30, 2024.

- GAAP Gross Profit: GAAP gross profit for the six months ended June 30, 2025 was $15.9 million, an increase of $12.9 million, or 420%, from $3.0 million in GAAP gross profit for the six months ended June 30, 2024, with the increase due primarily to a higher margin annealing quantum computer system sale during the six months ended June 30, 2025.

- GAAP Gross Margin: GAAP gross margin for the six months ended June 30, 2025 was 87.6%, an increase of 22.0% from the 65.6% GAAP gross margin for the six months ended June 30, 2024, with the increase due primarily to a higher margin annealing quantum computer system sale during the six months ended June 30, 2025.

- Non-GAAP Gross Profit: Non-GAAP Gross Profit for the six months ended June 30, 2025 was $16.3 million, an increase of $12.8 million, or 367%, from the Non-GAAP Gross Profit of $3.5 million for the six months ended June 30, 2024. The difference between GAAP and Non-GAAP Gross Profit is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Profit.

- Non-GAAP Gross Margin: Non-GAAP Gross Margin for the six months ended June 30, 2025 was 89.9%, an increase of 14.9% from the 75.0% Non-GAAP Gross Margin for the six months ended June 30, 2024. The difference between GAAP and Non-GAAP Gross Margin is limited to non-cash stock-based compensation and depreciation and amortization expenses that are excluded from the Non-GAAP Gross Margin.

- GAAP Operating Expenses: GAAP operating expenses for the six months ended June 30, 2025 were $53.6 million, an increase of $14.2 million, or 36%, from GAAP operating expenses of $39.4 million for the six months ended June 30, 2024, with the year-over-year increase primarily driven by increases of $6.6 million in salaries and related personnel costs, 80% of which relates to increases in Sales & Marketing and Research & Development staff; $2.9 million in non-cash stock-based compensation; $2.0 million in fabrication and related activities; $1.8 million in third party professional services and $1.3 million in marketing expenses. The increased operating expenses stem from incremental investments to support the Company’s continued growth and expansion.

- Non-GAAP Adjusted Operating Expenses: Non-GAAP Adjusted Operating Expenses for the six months ended June 30, 2025 were $42.4 million, an increase of $12.1 million, or 40%, from Non-GAAP Adjusted Operating Expenses of $30.3 million for the six months ended June 30, 2024, with the difference between GAAP and Non-GAAP Operating Expenses being primarily non-cash stock-based compensation expense, non-recurring one-time expenses, and depreciation and amortization.

- Net Loss: Net loss for the six months ended June 30, 2025 was $172.8 million, or $0.59 per share, an increase of $137.7 million, or $0.38 per share, compared with a net loss of $35.1 million, or $0.21 per share for the six months ended June 30, 2024. The increase was primary due to $138.1 million in non-cash, non-operating charges related to the remeasurement of the Company's warrant liability, as well as realized losses stemming from warrant exercises.

- Adjusted Net Loss: Adjusted Net Loss for the six months ended June 30, 2025 was $34.6 million, or $0.12 per share, essentially flat compared with the Adjusted Net Loss of $34.6 million, or $0.21 per share for the six months ended June 30, 2024, with the difference between Net Loss and Adjusted Net Loss being non-cash, non-operating warrant related charges.

- Adjusted EBITDA Loss: The Adjusted EBITDA Loss for the six months ended June 30, 2025 was $26.1 million, a decrease of $0.7 million, or 3%, from the six months ended June 30, 2024 Adjusted EBITDA Loss of $26.8 million, with the improvement due primarily to higher gross profit, partly offset by increased operating expenses.