SEALSQ Commits Up to $30 Million in Cryptocurrency Treasury to Accelerate Post-Quantum Cryptography Initiatives

Geneva, Switzerland, July 22, 2025 - SEALSQ Corp ("SEALSQ" or "Company"), a company that focuses on developing and selling Semiconductors, PKI, and Post-Quantum technology hardware and software products, today announced a bold strategic move to strengthen its position in the blockchain and post-quantum space. The company is establishing a cryptocurrency investment fund with a commitment of up to $30 million to invest in digital assets as part of its cryptocurrency treasury strategy.

This strategic allocation will directly support SEALSQ’s ongoing post-quantum cryptography initiatives, reinforcing its mission of enabling secure, decentralized infrastructures that are resilient to emerging quantum threats.

The cryptocurrency investment fund will serve as a strategic treasury vehicle and will be primarily allocated to a diversified portfolio of high-impact digital assets, including:

- QAIT – SEALCOINs native utility token designed to power its ecosystem of quantum-secure transactions and digital identity services.

- WeCan Token – Supports decentralized applications and tokenized asset solutions developed through SEALSQ partnerships. SEALSQ has already started investing in WeCan tokens.

- Hedera (HBAR) – A public distributed ledger known for its energy efficiency, enterprise-grade performance, and unique Hashgraph consensus algorithm.

- Bitcoin (BTC) – The most widely recognized and adopted cryptocurrency, serving as a long-term store of value.

- Ethereum (ETH) – A decentralized smart contract platform that pioneered programmable blockchain applications and supports a large ecosystem of dApps and developers.

A cryptocurrency treasury strategy involves buying and holding cryptocurrencies, similar to how companies may invest in traditional assets like bonds or equities. This approach provides financial flexibility, potential hedging opportunities, and strategic alignment with emerging digital ecosystems and innovative agendas.

“This commitment of up to $30 million is not just a financial investment—it is a strategic and technological one,” said Carlos Moreira, Founder and CEO of SEALSQ. “As quantum computing rapidly evolves, securing the future of decentralized technologies is no longer optional, it is essential. Through this cryptocurrency treasury initiative, we are reinforcing our commitment to a post-quantum world built on integrity, privacy, and decentralization.”

The cryptocurrency treasury will also create synergies with the utility tokens currently in use across SEALSQ-affiliated companies and support the launch of new tokens that are being planned as part of the Group’s broader Web3 and post-quantum blockchain strategy.

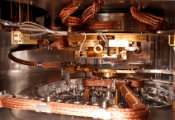

SEALSQ is also actively testing the use of cryptocurrencies and utility tokens for machine-to-machine (M2M) transactions, enabled by its post-quantum secure semiconductors embedded into a wide range of connected objects. The long-term vision is that future technologies, such as autonomous vehicles, industrial robots, and smart city infrastructures, will be able to autonomously pay and transact with each other using SEALSQ’s decentralized token ecosystem, unlocking a new era of secure, autonomous economic interaction.

Machine-to-machine (M2M) payments, facilitated by cryptocurrencies and blockchain technology, enable automated transactions between devices without human intervention. This integration, particularly within the Internet of Things (IoT), allows devices to interact, exchange services, and make payments autonomously. Blockchain’s security and transparency, along with the potential for instant settlement, make it a promising solution for M2M payments.

The Core Concept:

- M2M payments involve devices directly exchanging value (cryptocurrencies) for services or data.

- This eliminates the need for intermediaries like banks or payment processors, streamlining transactions.

- Examples include smart grids where appliances pay for electricity, or vending machines automatically restocking based on demand.

SEALSQ’s position to make this investment is bolstered by its robust financial standing, with the Company holding over $170 million in cash and cash equivalents as of July 15, 2025. This strong liquidity allows SEALSQ to make forward-looking investments without compromising its operational agility or R&D initiatives.

The cryptocurrency treasury will be actively managed with a long-term outlook and guided by the company’s cybersecurity principles and governance framework. It will also serve as a foundation for experiments in quantum-resistant decentralized finance (QR-DeFi) and secure Web3 infrastructure.

SEALSQ’s post-quantum roadmap includes hardware-based secure elements, root-of-trust technologies, and cryptographic chipsets embedded with next-generation algorithms designed to withstand the computational power of future quantum computers.